Elon Musk tweeted on Friday that his $44-billion money bargain for Twitter Inc (TWTR.N) was “briefly waiting” while he sits tight for the online entertainment organization to give information on the extent of its phony records.

Twitter shares at first fell over 20% in premarket exchanging, however after Musk, the CEO of electric vehicle market Tesla Inc (TSLA.O), sent a subsequent tweet saying he stayed focused on the arrangement, they recaptured some ground.

The offers were down 9.6% to $40.71 in early afternoon exchanging on Friday, a precarious rebate to the $54.20 per share securing cost.

Musk, the world’s most extravagant individual, chose to defer a reasonable level of investment when he consented to purchase Twitter on April 25, with an end goal to get the San Francisco-based organization to acknowledge his “best and last proposition.” This could make it harder for him to contend that Twitter some way or another misdirected him.

Since Musk inked his arrangement to get Twitter, innovation stocks have plunged in the midst of financial backer worries over expansion and a likely monetary stoppage.

The spread between the deal cost and the worth of Twitter shares had augmented lately, suggesting under a half opportunity of fulfillment, as financial backers guessed that the slump would incite Musk to leave or look for a lower cost. understand more

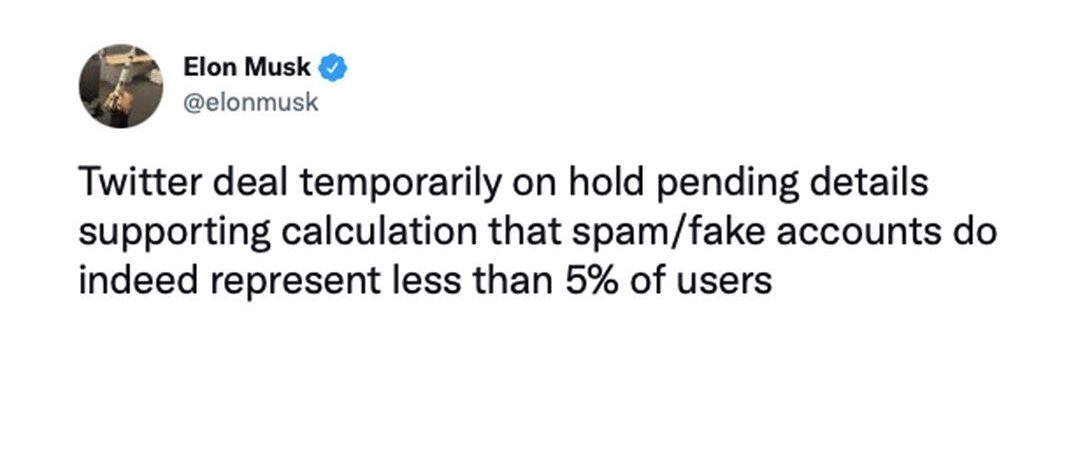

“Twitter bargain briefly on hold forthcoming subtleties supporting computation that spam/counterfeit records really do to be sure address under 5% of clients,” Musk told his in excess of 92 million Twitter devotees.

Under the details of Musk’s agreement with Twitter, he is qualified for ask the organization for data on its activities following the marking of the arrangement. In any case, this is intended to assist him with planning for his responsibility for, not to do a reasonable level of effort and resume exchanges.

Twitter is arranging no prompt activity against Musk because of Musk’s remark, individuals acquainted with the matter said. The organization considered the remark vilifying and an infringement of the details of their arrangement contract, however was energized by Musk in this manner tweeting he was focusing on the procurement, the sources added.

Musk came to Twitter’s office for a gathering on May 6 as a feature of the exchange arranging process, a Twitter representative said.

There was no prompt response from the financial backers that Musk tapped last week to bring $7.1 billion up in subsidizing for the Twitter bargain.

Spam or phony records are intended to control or misleadingly support action on administrations like Twitter. Some make a feeling that a person or thing is more famous.

Musk tweeted a Reuters story from ten days prior that refered to the phony record figures. Twitter has said that the figures were a gauge and that the real number might be higher.

Also Read: Samsung Holds First-Ever 6G Forum to Discuss Next-Gen Tech

The assessed number of spam accounts on the microblogging webpage has held consistent underneath 5% beginning around 2013, as indicated by administrative filings from Twitter, inciting a few examiners to address why Musk was raising it now.

“This 5% measurement has been out for quite a while. He plainly would have proactively seen it… So it likely could be all the more piece of the procedure to bring down the cost,” said Susannah Streeter, an investigator at Hargreaves Lansdown.

Agents for Musk didn’t promptly answer demands for input from Reuters.

Tesla’s stock rose 4% on Friday morning. The offers have lost about a fourth of their worth since Musk revealed a stake in Twitter of April 4, in the midst of worries he will get occupied as Tesla’s CEO and that he might need to sell more Tesla offers to support the arrangement.

Also Read: Jessica Simpson shows off VERY trim waist amid 100lb weight loss

There is a lot of point of reference for a possible renegotiation of the cost following a market slump. A few organizations repriced concurred acquisitions when the COVID-19 pandemic broke out in 2020 and conveyed a worldwide monetary shock.

In one example, French retailer LVMH (LVMH.PA) took steps to leave an arrangement with Tiffany and Co. The U.S. gems retailer consented to bring down the cost by $425 million to $15.8 billion.