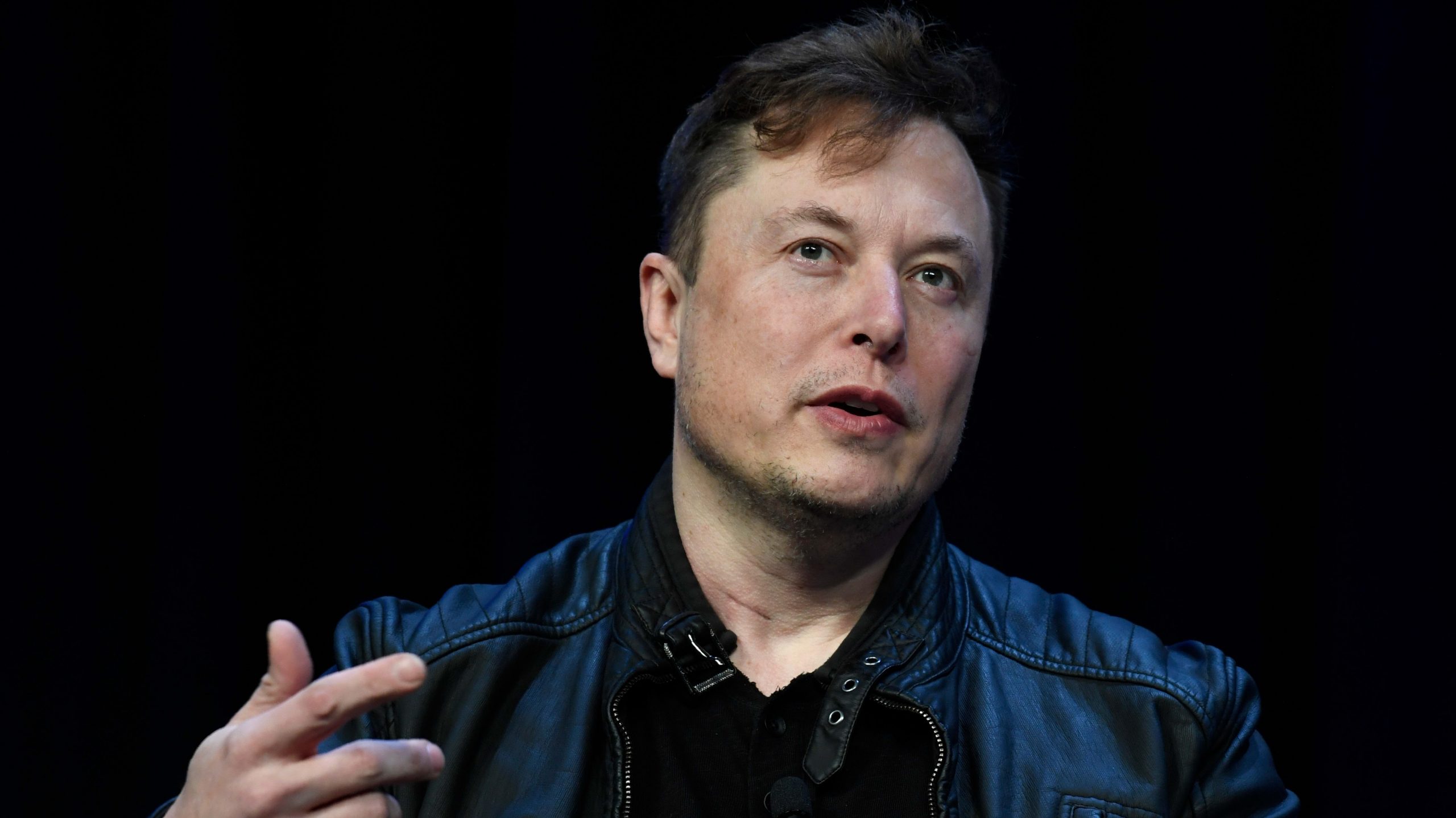

A recent lawsuit alleges that Elon Musk tried to manipulate the price of Twitter’s stock to increase his purchase price, and then doubled down, tweeting that the deal could not move forward. Lawyers for Twitter investors have said that Musk has continued to disparage the company and are trying to renegotiate the purchase price. They also say that Musk has violated California corporate laws by not disclosing his stake in the company earlier.

Elon Musk sued by Twitter investors for stock manipulation

Tesla and Twitter shares have fallen more than 20% since Musk announced his takeover bid. Musk’s stake in Tesla has also dropped by about 40%. Twitter shareholders claim that Musk violated California corporate laws and engaged in market manipulation. They claim that Musk did not disclose his 9% stake in Twitter and hid it from investors in early April. Musk also violated securities laws by using fake accounts to influence Twitter’s stock price.

As a result, a group of Twitter investors have sued Elon Musk for allegedly manipulating their stock during the takeover bid. While Musk has not publicly confirmed that he is buying Twitter, he has sowed doubts since he made the initial offer. One tweet suggested that Twitter misrepresented the number of spam and bot accounts on its platform. In mid-May, he tweeted that the takeover bid was “temporarily on hold.” This tweet coincided with a dramatic decline in the stock prices of Tesla and Twitter. The lawsuit is a sign of the tension between Twitter shareholders.

Also Read: The Best Weight Loss Supplements

Musk delayed disclosure of his stake in company

A lawsuit filed by a Virginia man claiming Elon Musk manipulated Twitter’s stock price while negotiating the takeover bid has raised questions about whether the billionaire should have disclosed his stake in the company before the deal closed. The billionaire is the owner of a stake in the company and has over 95 million followers. In April, he delayed disclosure of his stake in the company. He said earlier this month he was delaying the takeover until he could get more information about the potential use of “spam bots,” a tactic Musk has accused of manipulating Twitter stock.

As CEO of Tesla Inc., Elon Musk is the richest person in the world, valued at $276 billion. However, gains of $156 million are a drop in the bucket for Musk. His rocket company, SpaceX, and other business ventures have gained attention as well. It’s unclear whether he intentionally misled investors when he hid his stake in the company by filing misleading SEC forms and claiming to be a passive investor.

Musk violated California corporate laws

The lawsuit claiming that Elon Musk violated California corporate laws during the takeover bid for Twitter has raised an interesting question. What exactly did Musk do to violate the laws? It alleges that Musk improperly used Twitter’s stock price to manipulate its value and then later raised doubts about the transaction, using inflammatory tweets about users and bots. It goes on to allege that Musk violated the antitrust laws by misusing Twitter’s stock price data.

The lawsuit argues that Musk manipulated the price of Tesla stock by buying shares at a price below the market value. By violating the California Corporations Code, Musk could face penalties and fines if he is found to have violated the law. The lawsuit also alleges that Musk violated the public disclosure rules regarding stock price manipulation. In addition, he violated the disclosure rules by filing as a passive investor and then changing his status to a board member.

Also Read: Stocks Making the Biggest Moves After Hours