At Coinbase, we are always looking for ways to make using cryptocurrency easier for our users – and with the launch of their Layer 2 blockchain infrastructure, they’re doing just that! This new platform allows users to access a range of different DeFi protocols on one platform, making it much easier to take advantage of all the potential opportunities that DeFi has to offer. In this article, I will take an in-depth look at what the platform can do and how it works.

Coinbase Launch of Layer 2 Blockchain

Layer 2 blockchains offer a way to scale cryptocurrency networks without sacrificing decentralization or security. Coinbase’s recent launch of a Layer 2 blockchain is a big step forward for the adoption of these technologies.

Layer 2 blockchains use a second layer on top of the existing blockchain to process transactions more efficiently. This allows for higher transaction throughput without compromising security or decentralization.

Coinbase’s Layer 2 blockchain is based on the Plasma protocol. Plasma is a decentralized network that enables fast, cheap, and secure transactions. It is designed to work with any EVM-compatible blockchain, such as Ethereum.

The launch of Coinbase’s Layer 2 blockchain will help unlock the potential of DeFi (decentralized finance). DeFi applications often require high transaction throughput and low fees, which are difficult to achieve on current cryptocurrency platforms. Layer 2 solutions like Plasma offer a way to meet these needs while preserving the security and decentralization of the underlying blockchain.

Coinbase’s launch of a Layer 2 blockchain is a big step forward for the adoption of these technologies and will help unlock the potential of DeFi applications. As more developers and users turn to Layer 2 solutions, we can expect to see increased scalability, security, and decentralization in the cryptocurrency space.

How Layer 2 Blockchain works on Ethereum, Solana and other networks

Layer 2 (L2) blockchains are designed to improve upon the scalability of existing L1 blockchains like Ethereum. By using techniques like sharding and rollups, L2 chains can process transactions at much higher rates than their L1 counterparts. This is why many believe that L2 solutions will be key to unlocking the full potential of decentralized applications (dApps).

Coinbase, one of the leading cryptocurrency exchanges, has now launched its own L2 solution called Coinbase Layer 2 (CL2). CL2 is based on the open-source project Connext and uses a technique called “state channels” to enable off-chain transactions. This means that users can transact with each other without having to wait for confirmations on the underlying blockchain.

One of the key benefits of CL2 is that it allows for near-instant settlements. This is because state channel transactions are only finalized when both parties agree to the terms of the transaction. This is in contrast to traditional L1 blockchain transactions which can take minutes or even hours to confirm.

Another key advantage of CL2 is that it greatly reduces fees. Since state channel transactions are processed off-chain, they are not subject to network fees like traditional L1 blockchain transactions. This could potentially make dApp development much more affordable for developers and users alike.

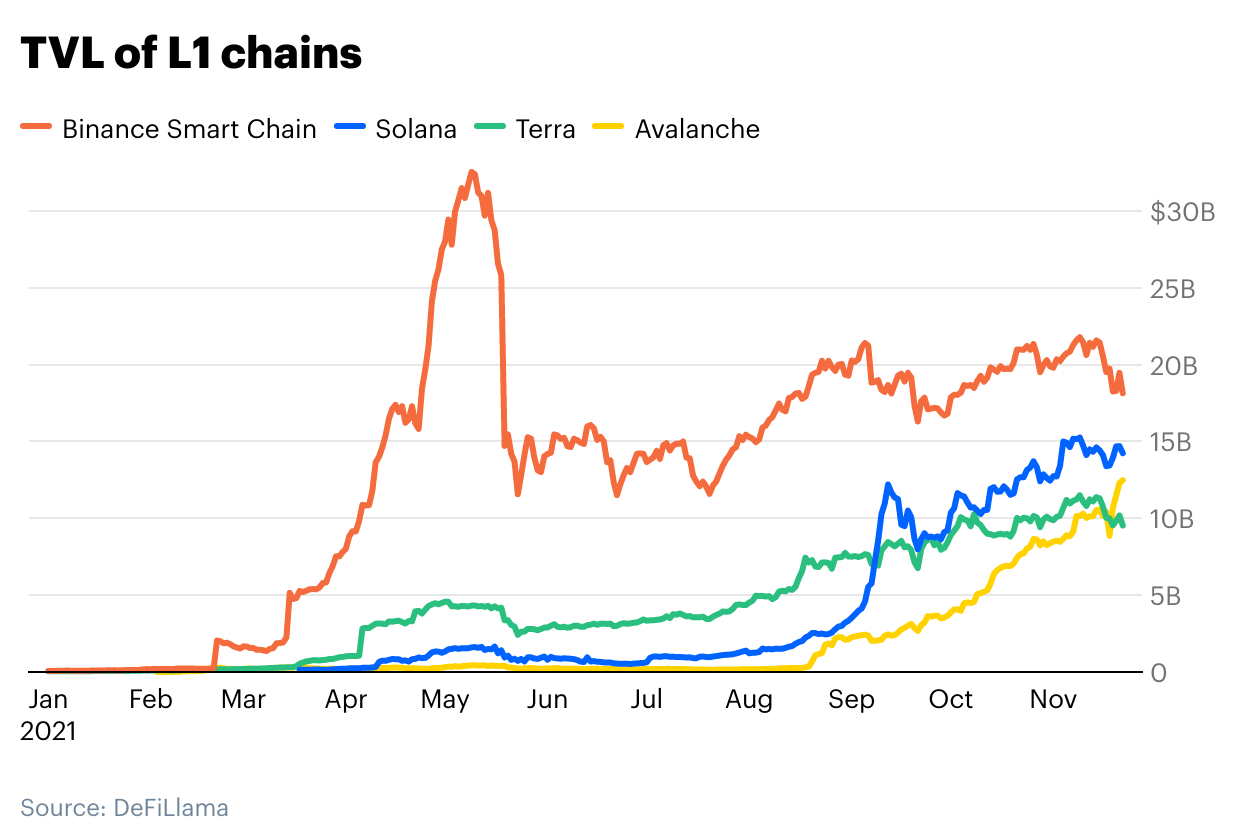

Coinbase plans to initially support Ethereum as well as ERC20 tokens on CL2. However, the company plans to eventually support other popular L 1 chains such as Solana, Binance Smart Chain, and Polkadot.

In summary, Layer 2 blockchains are designed to improve scalability, reduce transaction fees, and enable fast settlements. Coinbase’s CL2 is a great example of the power of L2 solutions and could significantly benefit dApp developers on Ethereum and other popular L1 networks.

The Benefits of Layer 2 Blockchain for DeFi Development

Layer 2 blockchains provide a much needed scalability solution for decentralized applications (Dapps) built on Ethereum. By rolling up multiple transactions into one “compressed” transaction, Layer 2 protocols can process many more transactions per second than Ethereum’s base layer alone. This is crucial for DeFi applications, which often deal with large numbers of transactions.

In addition, Layer 2 solutions offer lower transaction costs and improved speed and efficiency. These benefits are especially important for DeFi applications, which often rely on micro-transactions.

Finally, Layer 2 blockchains also provide increased security and reliability. By validating transactions off-chain, Layer 2 protocols can help prevent fraud and safeguard against malicious attacks. This is critical for ensuring the safety of user funds in the DeFi space.

Potential Risks of the new technology

The new technology that Coinbase is using to help unlock DeFi’s potential is called Layer Blockchain. There are a few potential risks associated with using this technology. First, it is possible that the data stored on the blockchain could be lost or corrupted. This would prevent users from being able to access their funds or use the platform to its full potential. Additionally, if hackers were able to gain access to the blockchain, they could potentially steal user data or disrupt the functioning of the platform. Finally, there is always the risk that new technologies will not live up to their hype and may not be as successful as hoped. However, it seems that Coinbase is confident in the potential of Layer Blockchain and is committed to working towards making DeFi a reality for everyone.

Examples of Current Projects Built with the New Technology

1. Synthetic assets: A synthetic asset is a digital asset that is backed by a physical asset, such as gold. The advantage of a synthetic asset is that it can be traded on a decentralized exchange, and the price is not subject to the whims of a central authority.

2. Decentralized lending: A decentralized loan is a loan that is not issued by a central authority, but rather by a group of lenders. This type of loan has the advantage of being more accessible to borrowers, as there are no credit checks or other barriers to entry.

3. Decentralized exchanges: A decentralized exchange is an exchange that does not rely on a central authority to match buyers and sellers. This type of exchange has the advantage of being more secure, as there is no central point of failure.

4. Tokenized real estate: Tokenized real estate is property that has been tokenized on a blockchain. The advantage of tokenized real estate is that it can be sold or rented without the need for a middleman.

5. Prediction markets: Prediction markets are markets where participants can bet on the outcome of events. The advantage of prediction markets is that they can be used to predict the future price of assets, and thereby help investors make better decisions.

Future Outlook Of Layer 2 Blockchain

Layer 2 blockchain solutions offer a way to scale the Ethereum network without compromising on decentralization or security. Coinbase is one of the leading companies working on this technology and they have just launched their newest product, Coinbase Enterprise Layer 2. This solution is designed to help businesses unlock the potential of decentralized finance (DeFi) applications by providing them with a scalable and secure platform to build on.

So far, Ethereum has been the go-to protocol for DeFi projects but its scalability issues have been a hindrance to its growth. With layer 2 solutions like Coinbase Enterprise Layer 2, businesses will be able to build on a scalable and secure platform that can handle large amounts of traffic without sacrificing decentralization or security. This will allow DeFi projects to reach their full potential and could lead to mass adoption of these technologies in the near future.

Conclusion

Coinbase’s Layer 2 blockchain is a revolutionary technology that has the potential to revolutionize DeFi and unlock its full potential. The launch of this technology gives users access to an unprecedented level of scalability, privacy, and speed while still maintaining all the decentralization features they have come to expect from traditional blockchains. This will enable developers to create more advanced dApps with improved user experience, which should significantly increase adoption rates in the near future. Coinbase’s focus on unlocking DeFi’s untapped potential bodes well for the optimistic future of decentralized finance as it continues its march towards mainstream adoption.