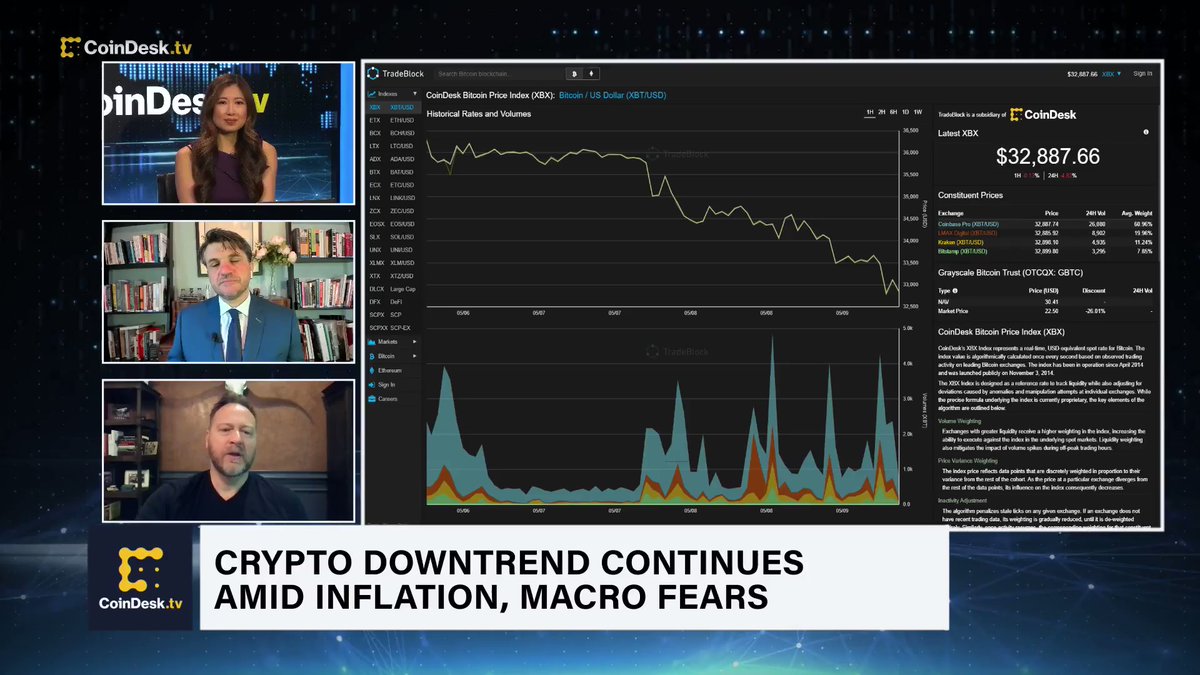

The market is descending and the global cryptocurrency price has plunged further. There are a lot of reasons why. HDFC (Housing Development and Finance Corporation) raised its retail prime lending rate and RPLR (Relative Prime Lending Rate), the benchmark for Adjustable Rate Home Loans. LIC opened its IPO on Wednesday, May 4, and has seen a strong response from its policyholders. All these factors have helped the global cryptocurrency market spiral downward even further.

Cryptocurrencies

In a major market bloodbath, cryptocurrencies have suffered the worst day since the last bear market, when the top cryptocurrencies lost more than 50% of their value in a single day. The price of Bitcoin has dipped below $27K for the first time since May 2016. The reason for the massive drop in Bitcoin price is that the Reserve Bank of India has raised key interest rates, and a host of banks have followed suit. According to the RBI, inflationary pressure is widespread across sectors and the situation is likely to remain gloomy in the near future.

Ethereum

The current Ethereum price is still relatively low, but it may soon rise as the platform grows and develops. A significant portion of the Ethereum supply is increasing every year, resulting in a steady increase in the price. A thriving community also contributes to the growth of the Ethereum network. As a result, there are several reasons why the Ethereum price has increased in recent months. But these reasons alone should not be enough to convince you to invest in Ethereum.

lfg

BTC is in the midst of a bear market after the non-profit Luna Basis Guard purchased Bitcoin to help preserve the UST peg. When BTC plunged below $30,000, their reserves ratio to UST issued plummeted. Regulators have begun to raise concerns over the transfer, with U.S. Treasury Secretary Janet Yellen citing the UST subject when pushing for stablecoin regulations.

solana token

A four-hour Solana price analysis issues a sell signal. Of the 26 major technical indicators, 15 support bears and only one supports bulls. The remaining eight indicators remain neutral. Considering the bearish bias, SOL is currently a strong sell. Despite this bearish outlook, the price is trading below its 12-EMA. Bitcoin is also under pressure with a falling dollar, which is bad news for cryptocurrency investors.

market pullback

In the aftermath of a bullish ETH upgrade, a popular altcoin has also suffered a steep drop in price. At press time, ethereum is trading at $1,758, down 6% over the past 24 hours. Earlier today, ethereum fell to a three-week low, hitting $1,721 compared to a May high of $4,000 a token. While the ETH price is a negative, other prominent altcoins are still nursing losses of 10% and more.

Fed’s interest rate hike

Earlier, on May 11, the Reserve Bank of India hiked key interest rates. The move came as inflationary pressure continued to build across sectors. The hike was accompanied by a host of bank rate rises. Today, the RBI will give a statement at 2 PM. This is likely to be bearish news for cryptocurrencies. However, bearishness is not confined to the cryptocurrency market, as many others are feeling the pinch.

Also Read: Gucci Stores to Accept Cryptocurrencies in US